September 2025 Market Update & Review

We are 75% through 2025, which doesn’t compute in my brain, but yet, here we are. Let’s dive into the data from September in the Denver real estate market!

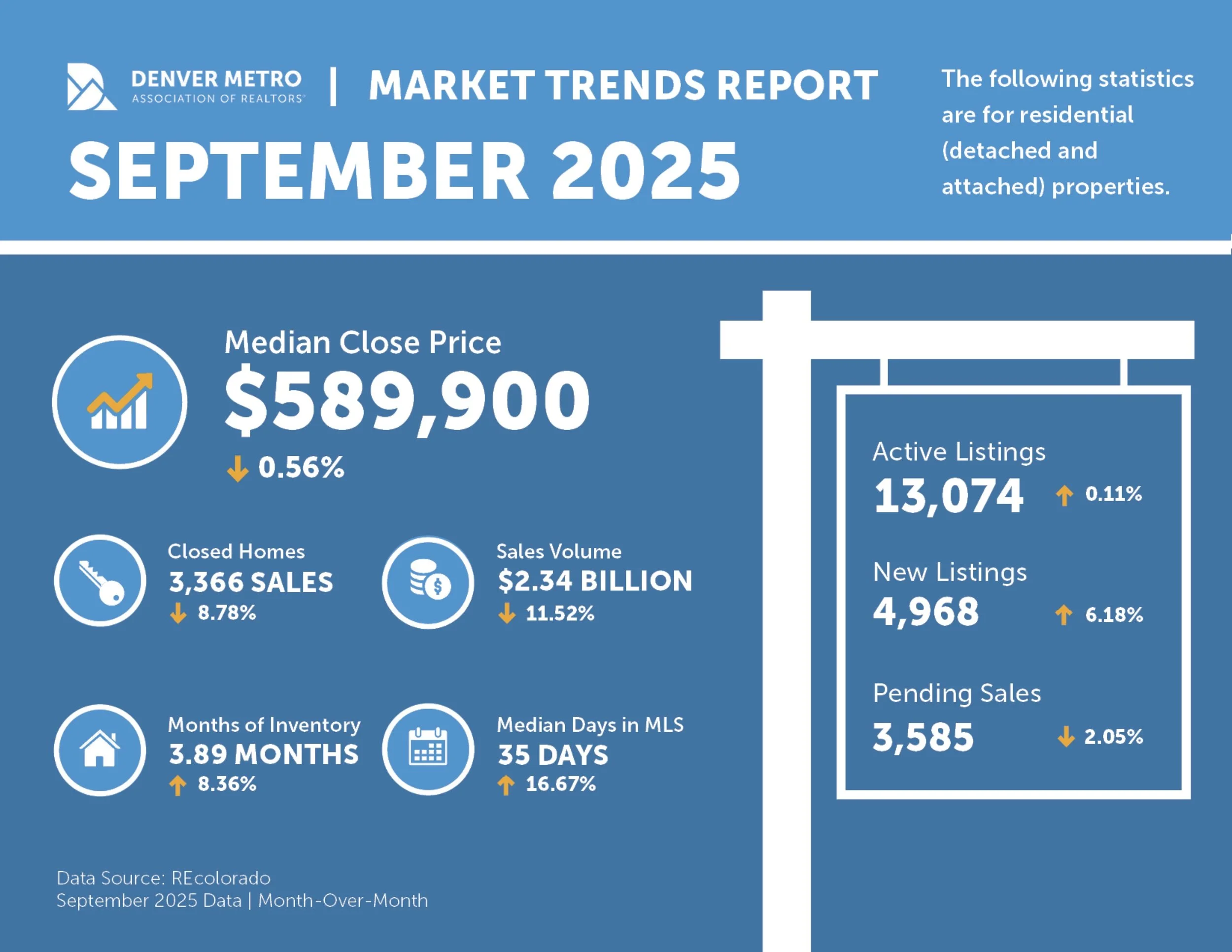

Median close price is down ever so slightly at .56%. Closed sales, sales volume, and pending sales are also down, meaning fewer closings happened in September compared to August. Months of inventory rose just over 8% to 3.89. This means if no new homes were added to the market, it would take just under 4 months to sell out of all the existing homes on the market. It also means buyers have ~4 homes to choose from that fit their criteria, so sellers need to be prepared to showcase their home in the best possible way. Paint! Service your major systems! Professional cleaning! Cross those items off your home list that you haven’t gotten to. Preparation will pay off.

Pending sales dropped by about 2% as we head into a slower season of the real estate market for both attached and detached homes.

Median and average close prices dropped from last month, but prices remain high overall. With all the listings on the market, it’s a great time for buyers to negotiate money off list price and/or concessions to cover closing costs and rate buydowns. Sellers need to price appropriately and be prepared for these negotiations with buyers.

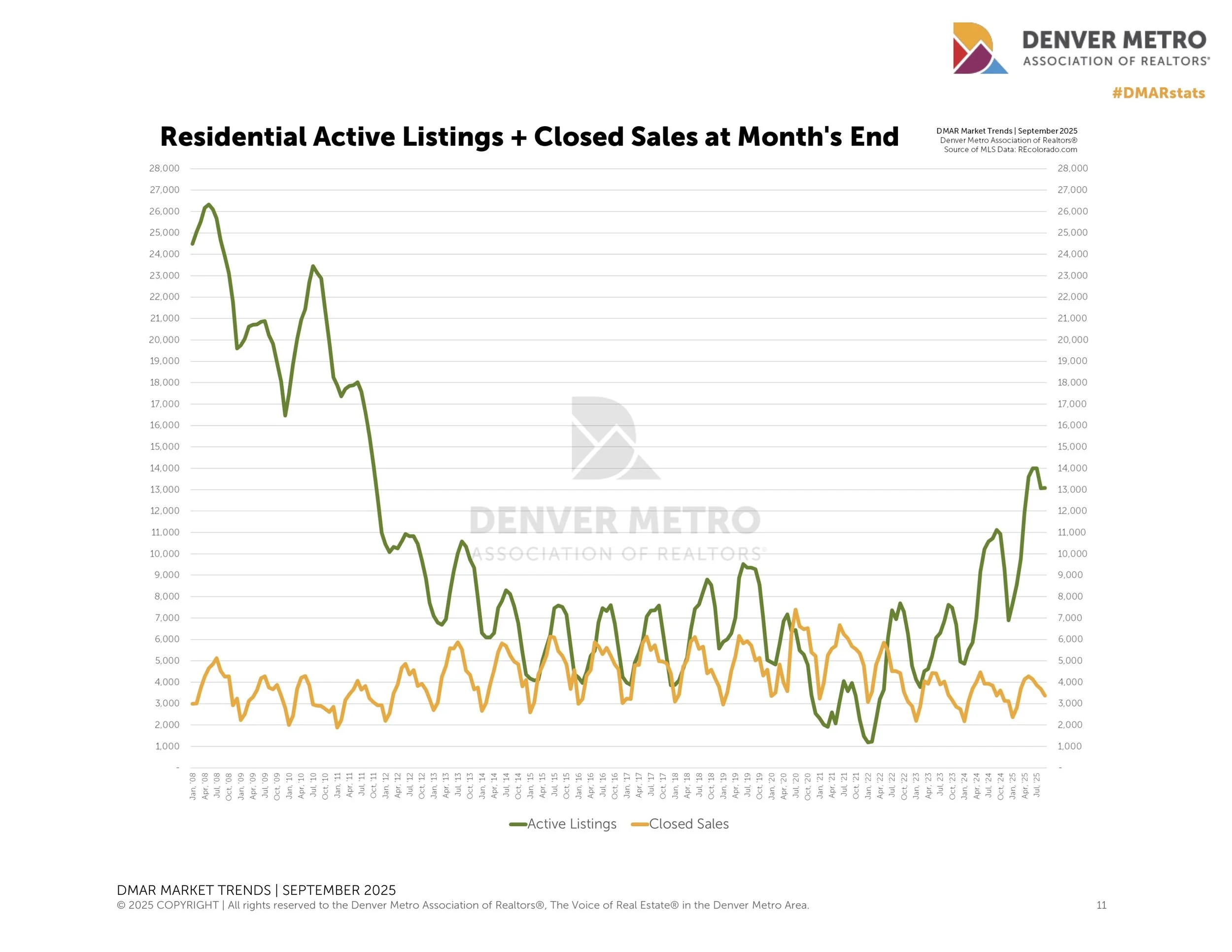

We’re seeing a lot of active listings on the market, more than the past decade. We are seeing a seasonal drop in active listings begin. Either because buyers are going under contract, or sellers are taking their listings off the market in advance of the slower fall and winter season, and will likely re-list next spring.

Since buyers have so many homes to choose from, median days on the market continue to rise. Gone are the days of 2021 when homes only stayed on the market for 5 days. Sellers need to be prepared to sit on the market for 30+ days. This depends on your neighborhood, price, and quality of home. If you are curious what your neighborhood and zip code look like in this market, please reach out. I’m happy to run reports for you and show you what your ‘micro-market’ is doing.

I always share this graph that dates back to the 2008 market crash. While we still have many listings on the market, we are nowhere near the crash of 2008. Prices are steady and buyers are still purchasing, despite the slowdown.